Design, Applications, and Market Trends of Industrial Chillers Abstract

1. Introduction

Industrial chillers are essential for maintaining thermal stability in manufacturing, healthcare, and commercial buildings. They operate on the vapor-compression refrigeration cycle, transferring heat from a process or environment to a cooling medium (air or water). With industries increasingly prioritizing energy efficiency and precision, chillers have evolved to meet demands for high-performance cooling solutions. This paper examines their technical design, operational efficiency, and global market landscape, focusing on innovations in energy-saving technologies and integration with IoT systems.

2. Technical Principles of Chillers

2.1 Vapor-Compression Refrigeration Cycle

The core operation of a chiller involves four stages:

-

Compression:

- A compressor (e.g., reciprocating, screw, or centrifugal) compresses low-pressure refrigerant vapor into high-pressure, high-temperature gas.

-

Condensation:

- The hot refrigerant gas enters the condenser, where it releases heat to ambient air or cooling water, condensing into a high-pressure liquid.

-

Expansion:

- The liquid refrigerant passes through an expansion valve, reducing its pressure and temperature, transforming it into a low-pressure liquid-vapor mixture.

-

Evaporation:

- The cold mixture absorbs heat from the process fluid (e.g., water or glycol) in the evaporator, reverting to vapor and completing the cycle.

2.2 Key Components

-

Compressor:

- The "heart" of the chiller. Screw compressors (e.g., Bitzer or Copeland) are favored for mid-to-large-scale systems due to high efficiency (EER up to 5.0) and durability.

-

Condenser:

- Air-cooled condensers use ambient air for heat dissipation, while water-cooled systems employ cooling towers for higher efficiency.

-

Evaporator:

- Plate-type evaporators (e.g., Alfa Laval) offer compact designs and high heat transfer rates, ideal for precision applications.

-

Expansion Valve:

- Thermal expansion valves (TEVs) or electronic expansion valves (EXVs) regulate refrigerant flow for optimal performance.

2.3 Types of Chillers

-

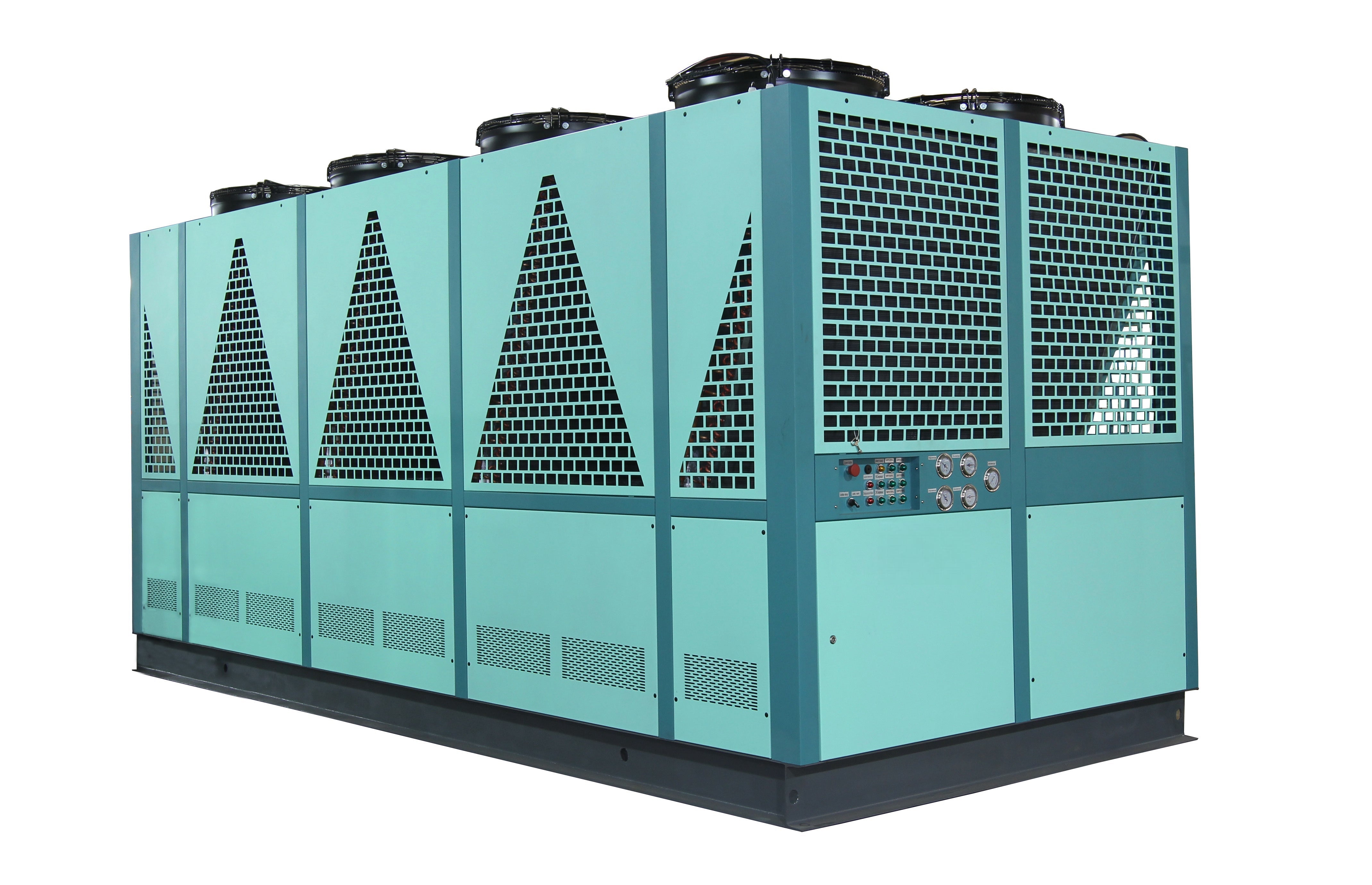

Air-Cooled Chillers:

- Suitable for outdoor installations with limited water availability.

-

Water-Cooled Chillers:

- Preferred for large-scale HVAC systems due to higher efficiency (COP up to 6.0).

-

Absorption Chillers:

- Use thermal energy (e.g., steam or natural gas) instead of electricity, ideal for waste-heat recovery.

3. Industrial Applications

3.1 Manufacturing and Process Cooling

-

Laser Cutting/Welding:

- Chillers like the S&A CWFL-8000 maintain ±0.1°C stability for high-power lasers, ensuring consistent beam quality and material integrity.

-

3D Printing:

- Metal additive manufacturing (e.g., SLM/DMLS) relies on chillers to stabilize laser diodes and melt pools.

-

Chemical Processing:

- Precise temperature control (down to -100°C) for exothermic reactions and crystallization.

3.2 HVAC and Commercial Buildings

-

Central Air Conditioning:

- Chillers cool water circulated through fan coils or VAV systems, covering over 28% of U.S. commercial building floor space.

-

Data Centers:

- High-density server racks require liquid cooling systems to prevent overheating.

3.3 Healthcare and Pharmaceuticals

-

Vaccine Production:

- Chillers maintain sterile environments (2–8°C) for bioreactors and storage.

-

MRI Machines:

- Cryogenic cooling for superconducting magnets using specialized refrigerants like R-134a.

4. Market Trends and Competitive Landscape

4.1 Global Demand Drivers

-

Energy Efficiency Regulations:

- ASHRAE Standard 90.1 and EU Ecodesign Directive push manufacturers to adopt high-efficiency chillers (e.g., COP > 5.0).

-

Industrial Automation:

- Growth in robotics and IoT-driven manufacturing increases demand for precision cooling.

-

Renewable Energy:

- Solar farms and wind turbines use chillers to cool inverters and gearboxes.

4.2 Regional Market Dynamics

-

Asia-Pacific:

- China’s chiller market grows at 6% CAGR, driven by semiconductor and EV battery manufacturing.

-

North America:

- Retrofits of aging HVAC systems in commercial buildings boost demand for modular chillers.

4.3 Key Players

-

Trane Technologies:

- Leading provider of centrifugal chillers with magnetic bearing compressors (e.g., Series E).

-

Mitsubishi Heavy Industries:

- Specializes in absorption chillers for combined heat and power (CHP) systems.

-

Beijing Huanqiu United:

- Innovates in ultra-low-temperature (-80°C) and AI-controlled chillers for pharmaceuticals.

5. Future Innovations

5.1 Smart and Connected Systems

-

AI-Powered Optimization:

- Predictive maintenance using IoT sensors to monitor compressor wear and refrigerant leaks.

-

Digital Twins:

- Virtual simulations for real-time performance adjustments and energy savings.

5.2 Sustainable Refrigerants

-

Low-GWP Alternatives:

- Adoption of R-32 and CO₂ (transcritical systems) to replace R-134a and R-410A.

-

Natural Refrigerants:

- Ammonia (R-717) for industrial applications due to zero ODP and high efficiency.

5.3 Modular and Custom Solutions

-

Containerized Chillers:

- Pre-engineered systems for rapid deployment in remote locations.

-

Hybrid Cooling:

- Integration of evaporative cooling and heat recovery for dual-purpose systems.

6. Conclusion

Industrial chillers are indispensable in modern manufacturing and climate control, with advancements in energy efficiency and smart technology reshaping the industry. As global markets demand sustainable and intelligent solutions, innovations in compressor design, refrigerant alternatives, and IoT integration will drive future competitiveness. With the global chiller market projected to reach $107.4 billion by 2029 (5.31% CAGR), companies prioritizing R&D in eco-friendly and AI-driven systems will lead the next phase of growth.